Blog

The niche where numbers dance, and fortunes are calculated in decimals is Finance. No matter how you slice it, everyone loves money, regardless of the season or economic climate. And this is the beauty of finance offers. Moreover, each can choose the offer according to their taste – there are plenty of options in the finance market: from bank cards to mortgages and insurance programs.

This affiliate marketing finance guide will unveil all aspects of the vertical. You’ll learn what finance offers are in the niche, how to work with them, and what pitfalls you may encounter.

Given the different ways people handle their money, the finance niche includes offers that vary in risk levels. Several of them are controversial, such as binary options or bail bonds, prohibited by Facebook, the strictest ad platform. Moving away from the extremes, we’ll describe common types of finance offers you may encounter most often.

Bank card offers encompass promotions encouraging individuals to apply for either debit or credit cards. Affiliates earn commissions when users successfully apply for a bank card through their referral links.

Debit cards, directly linked to users’ bank accounts, offer immediate access to funds and are ideal for everyday transactions. On the other hand, credit cards provide a pre-approved limit, enabling users to make purchases beyond their current financial means. These affiliate marketing financial services can help build credit history and often come with rewards programs, while debit cards promote budget-friendly spending.

How to navigate the niche:

The loan products category, covering personal loans, mortgage loans, and payday loans, presents diverse opportunities for affiliate marketing.

Affiliates can emphasize the convenience and quick approval processes of payday loans, appealing to users in urgent financial situations. However, the payday loan niche often faces regulatory challenges and scrutiny. Personal loans can be marketed based on flexibility and competitive interest rates. Affiliates focusing on the long-term investment aspect can benefit from mortgage loans. However, the mortgage market involves a lengthy and complex application process, making user acquisition more challenging for affiliates.

How to navigate the niche:

If quick validation and faster commissions are priorities, payday loans may be suitable. For affiliates seeking higher payouts and willing to invest time in user acquisition, personal loans and mortgages offer substantial earnings. Be mindful of compliance and regulatory considerations in the payday loan niche.

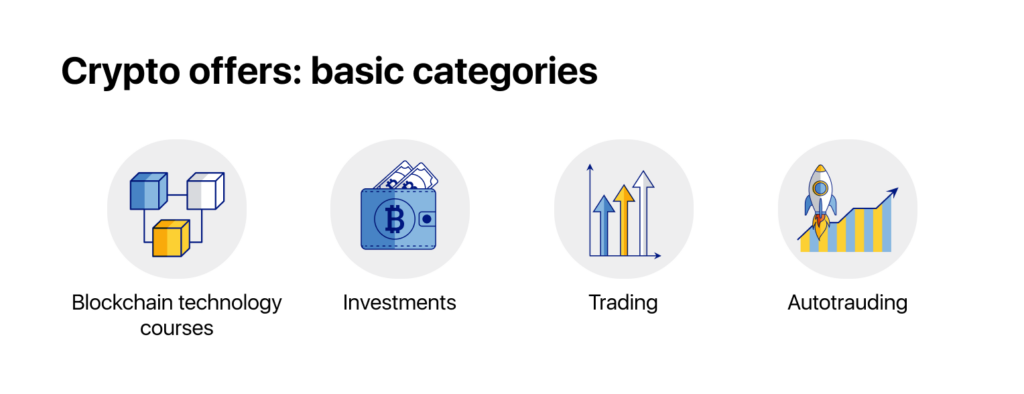

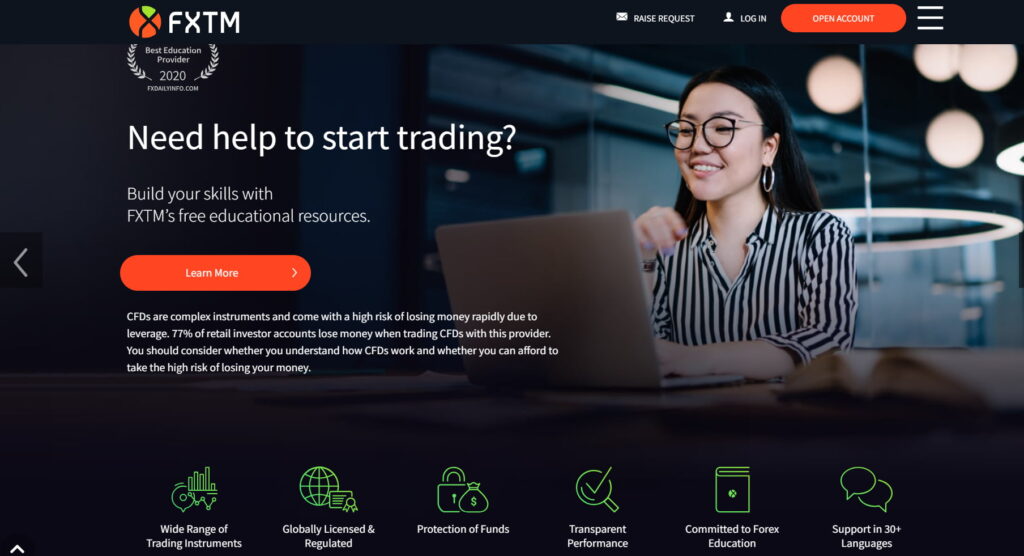

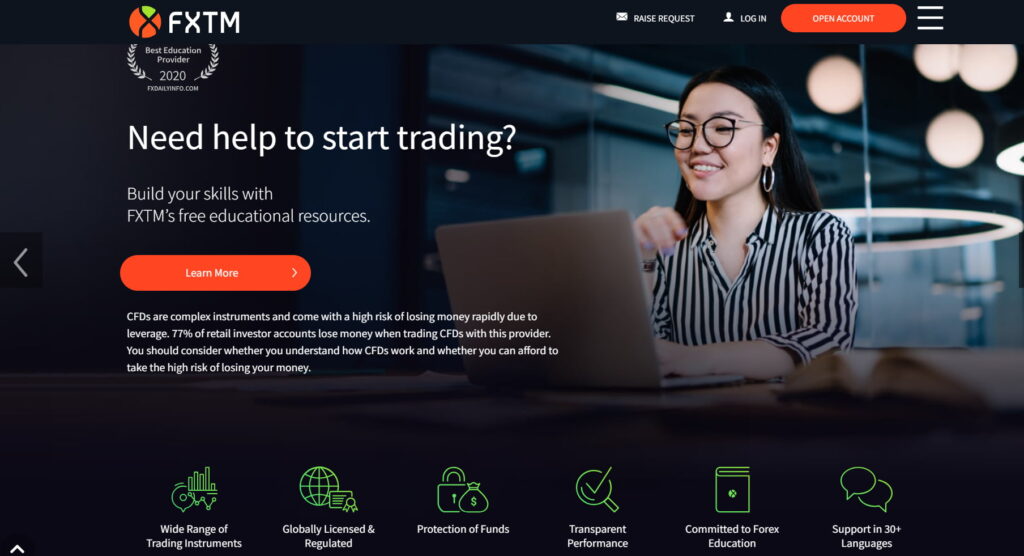

Affiliate marketing for investment and trading platforms involves promoting services enabling users to invest in stocks, cryptocurrencies, or financial instruments, such as Forex. Commissions are often tied to user registrations or deposits.

Cryptocurrencies deserve special attention as this niche involves a unique approach to making creatives and promotional strategies.

That’s why cryptocurrencies are often singled out as a separate vertical. We have a dedicated guide about Crypto.

Microfinance organizations (MFOs) are entities that offer financial services, such as small loans and financial products, to both individuals and businesses. These organizations play a crucial role for those who may not qualify for traditional bank loans. MFOs typically offer various types of loans with a focus on short-term financial needs. The key advantage lies in their ability to serve a diverse audience, offering quick approvals and flexibility in loan types to address specific financial circumstances.

Choose MFO offers when aiming for quick conversions, targeting a diverse audience underserved by traditional banks, and seeking flexibility in promotion strategies. MFOs are ideal for affiliates prioritizing short-term financial solutions, higher approval rates, and a varied portfolio to cater to different user needs.

Before diving headfirst into finance offers and their advantages, you should know about all possible roadblocks that can bother paving the way for entering the industry.

What difficulties advertisers may face when advertising finance offers:

All in all, dealing with finance affiliate marketing demands a meticulous and patient approach. Advertisers must delve into the intricacies of the target audience, navigate approval processes, and patiently invest time and resources. The rewards, however, are substantial, with diligent efforts resulting in a lucrative return on investment.

Views on why finance offers can be highly profitable for you.

Finance offers cater to a broad and diverse audience. From individuals seeking credit cards to those interested in investments, the potential consumer base is vast. This diversity allows advertisers to tailor campaigns to different segments, reaching a wide spectrum of potential customers.

Finance encompasses a plethora of products and services – credit cards, loans, investments, insurance, and more. Advertisers can capitalize on this variety to promote an array of offers. This not only widens the scope for audience engagement but also allows for strategic marketing based on the ever-evolving needs of consumers.

For those seeking handsome payouts, finance offers stand out with their high-earning potential. What makes it even more enticing is the prevalence of the revenue-sharing model in the finance industry. Unlike one-time payout structures, this approach ensures advertisers not only receive generous initial payments but also a continuous percentage from the lasting revenue generated by their referred clients.

When it comes to promoting finance offers, the choices seem endless. Let’s simplify it.

Here’s a rundown of user-friendly traffic sources and their key benefits for running finance ad campaigns:

Amidst these options, push notifications stand out for finance offers. Their immediacy and ability to capture attention make them ideal for financial promotions.

Push notification networks add an extra layer of efficiency, ensuring your finance messages reach the right audience swiftly. Consider this dynamic duo – push notifications and push networks – for a winning strategy in the finance advertising game. Embark on your finance campaign journey with the best push ad networks.

The target audience for finance offers is extremely diverse, as users can have completely different attitudes toward finances. While some are saving up and looking for profitable deposits to invest in, others waste money, resulting in the need for MFOs.

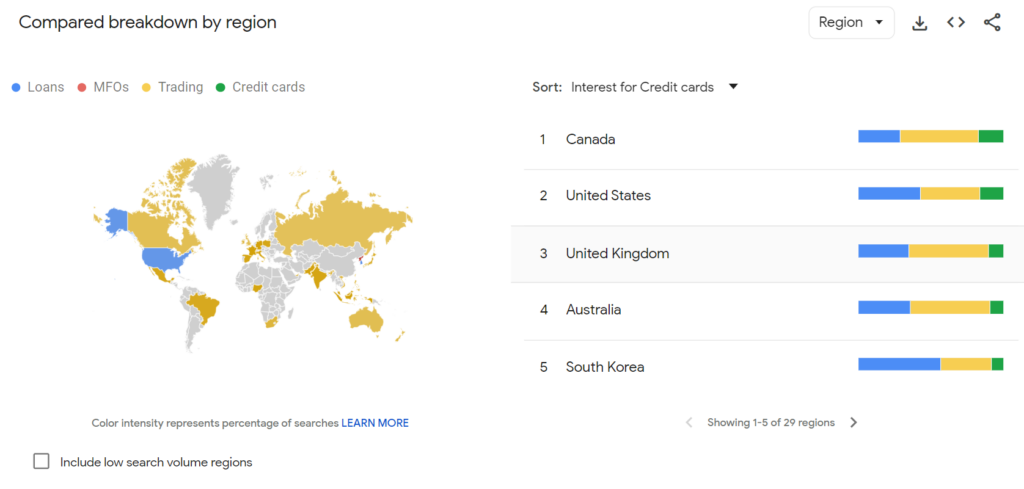

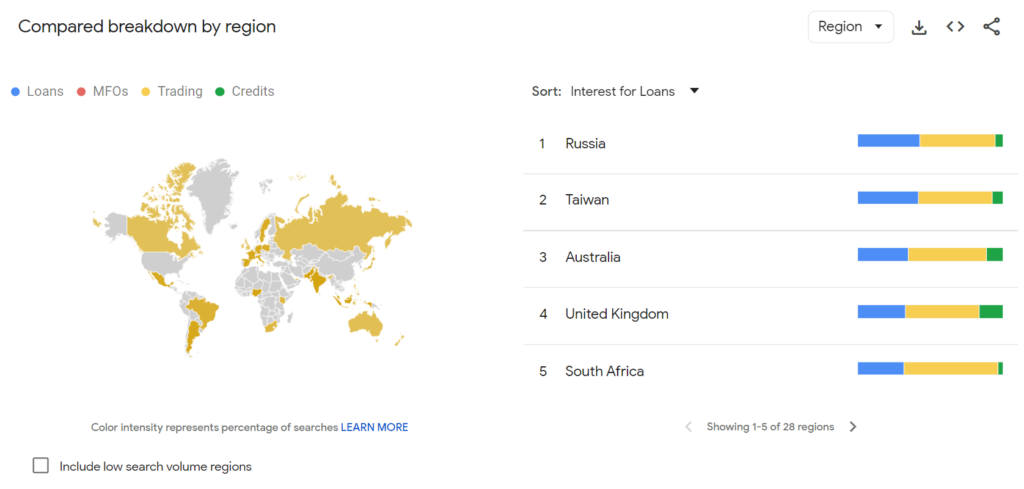

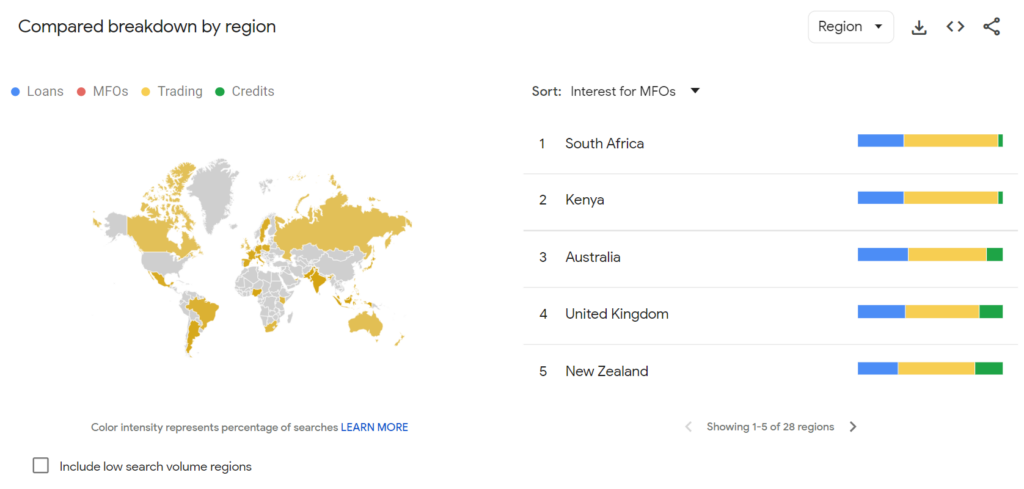

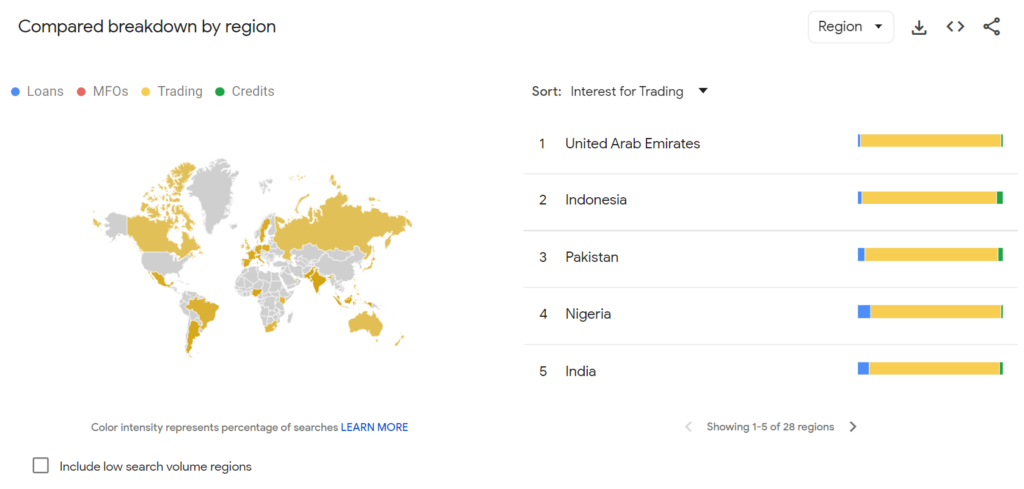

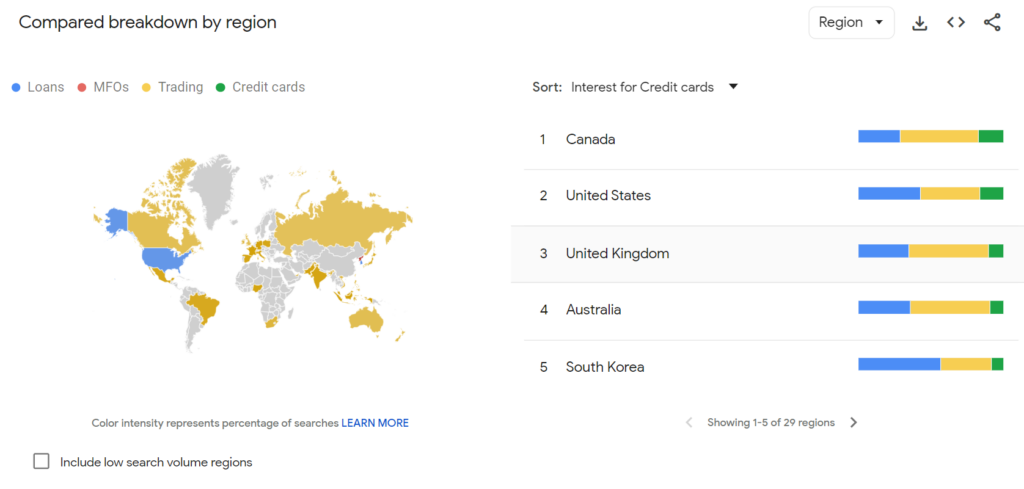

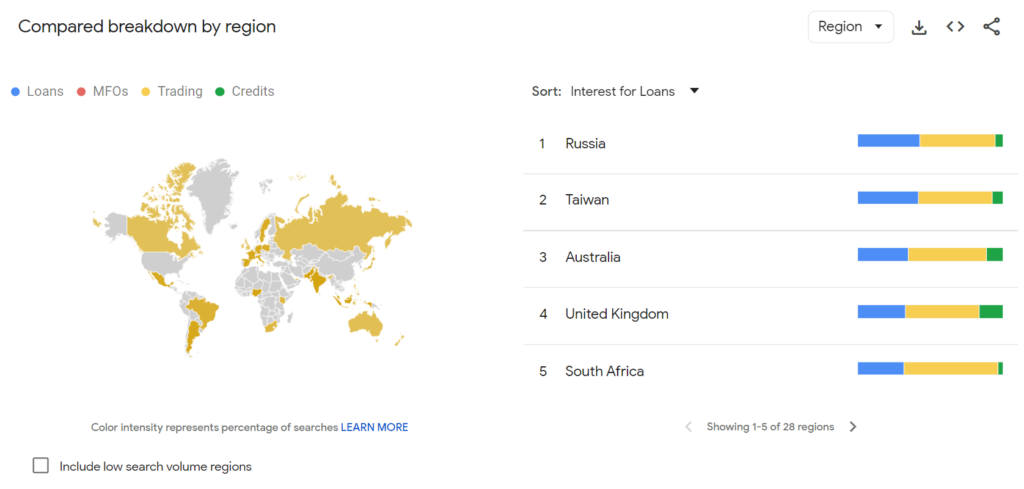

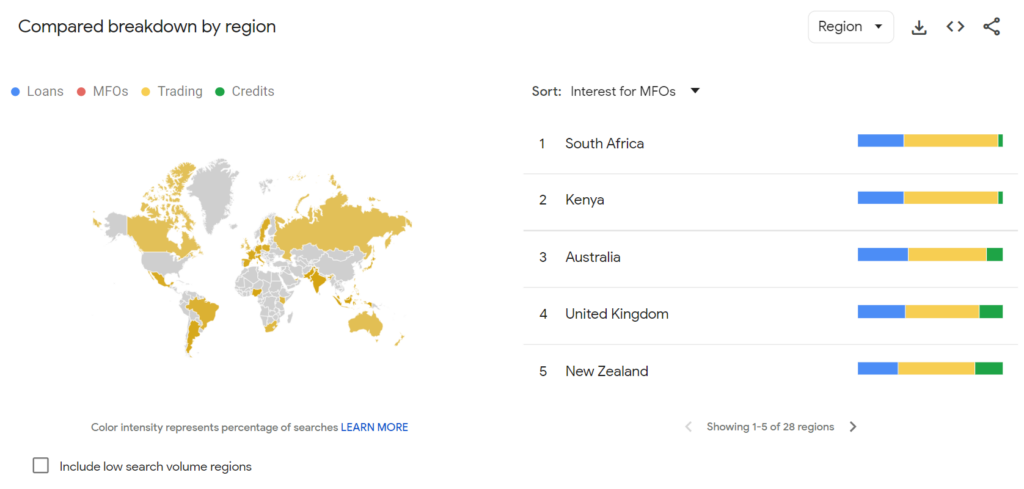

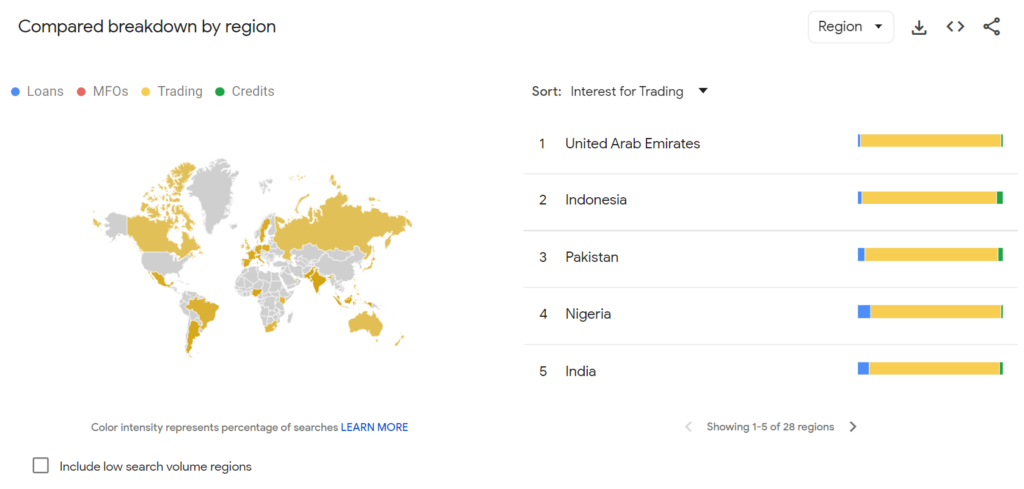

Additionally, there are various biases, such as the misconception that only the population of tier-3 countries is interested in loans, for example. To stay informed, we cross-referenced data with Google Trends statistics, identifying which traffic performs best across different GEOs.

Statistics show credit cards are viable for even such solvent countries as Canada, the US, the UK and Australia. South Korea rounds out this TOP-5.

Loan inquiries garner attention from audiences in Russia, Taiwan, Australia, the UK, and South Africa. Seek traffic sources that specialize in these GEOs to profit from loan advertising.

Those most interested in MFOs are located in South Africa, Kenya, Australia, the UK, and New Zealand.

Trading is predominantly a passion for the population from the UAE, Indonesia, Pakistan, Nigeria and India.

Make sure your target GEO compiles with the traffic source you choose for promoting your offer. Check out what countries are profitable in terms of Finance in the following ad networks: PropellerAds, Adsterra, Galaksion, Push.House, EZmob, AdCash and Kadam.

Advertisers have the creative freedom to incorporate diverse elements into their sales funnels. This could involve enticing lead magnets, such as exclusive financial guides or personalized budgeting tools, delivered directly to users’ inboxes.

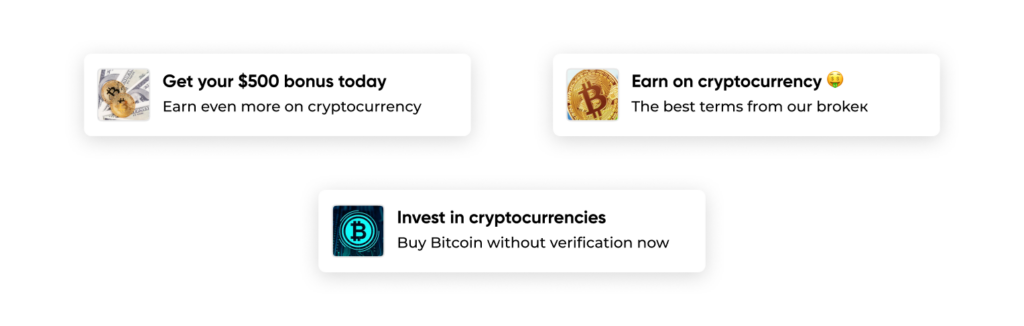

Crypto adoption means fintech services start using digital currencies like Bitcoin. It’s simple and can make things like paying and getting paid quicker, safer, and cheaper because it doesn’t rely much on banks or government rules. It also gives everyone using these services more privacy. Plus, embracing crypto can be a big plus for an offer, making it stand out and more appealing to people looking for modern, secure financial solutions.

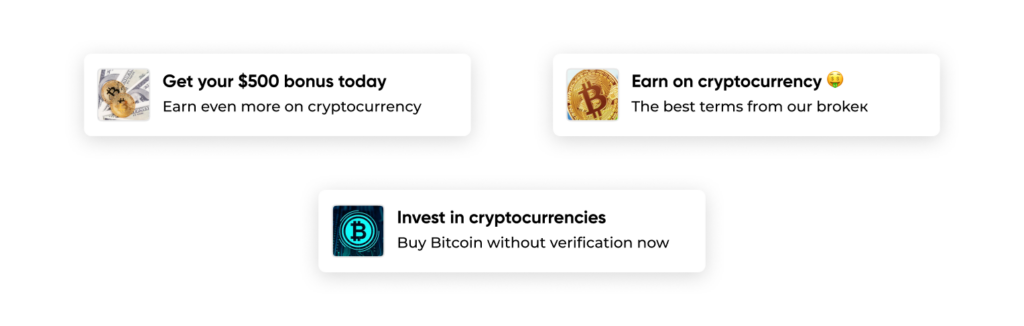

An example of in-page push creatives for the finance niche (crypto):

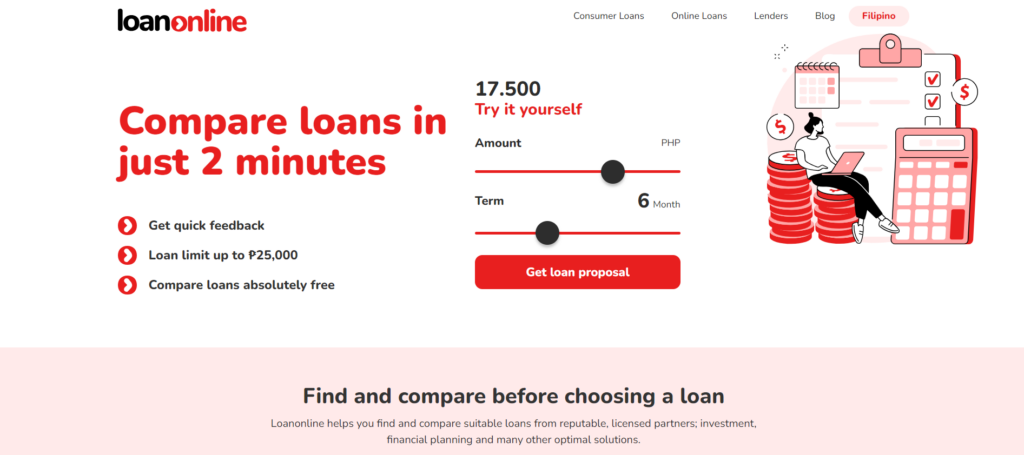

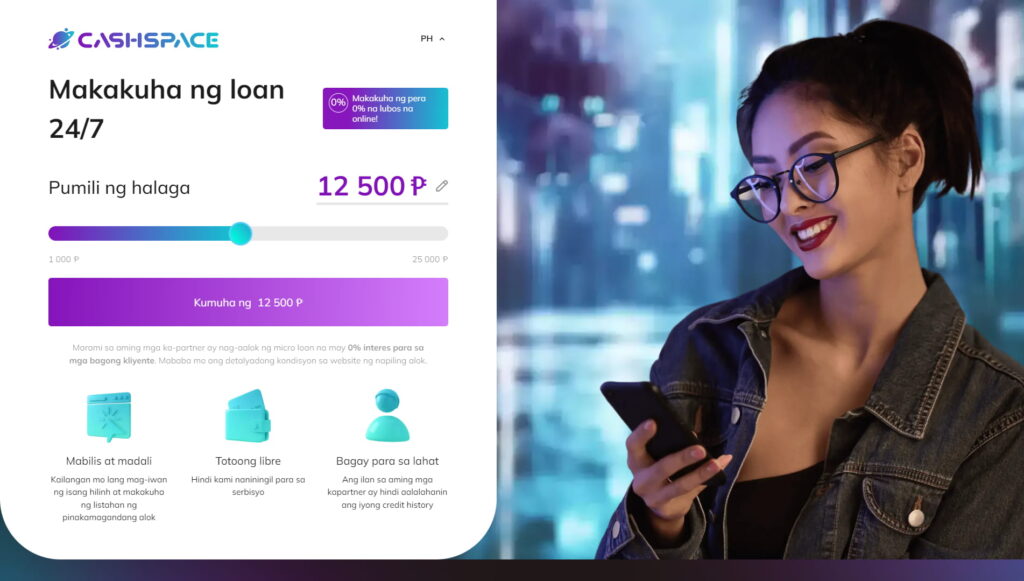

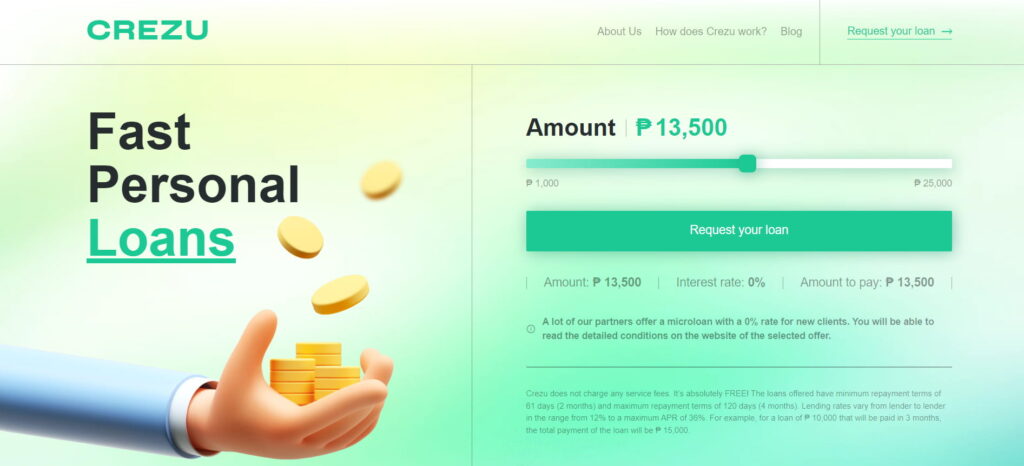

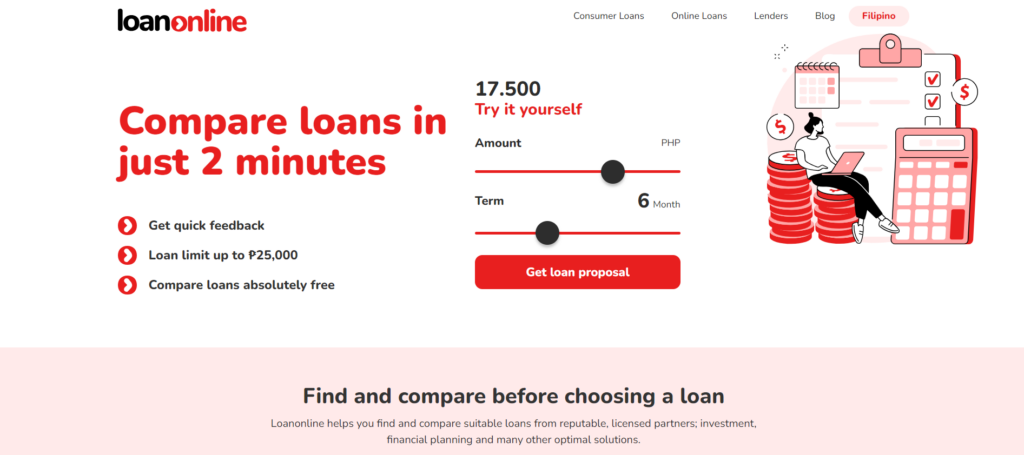

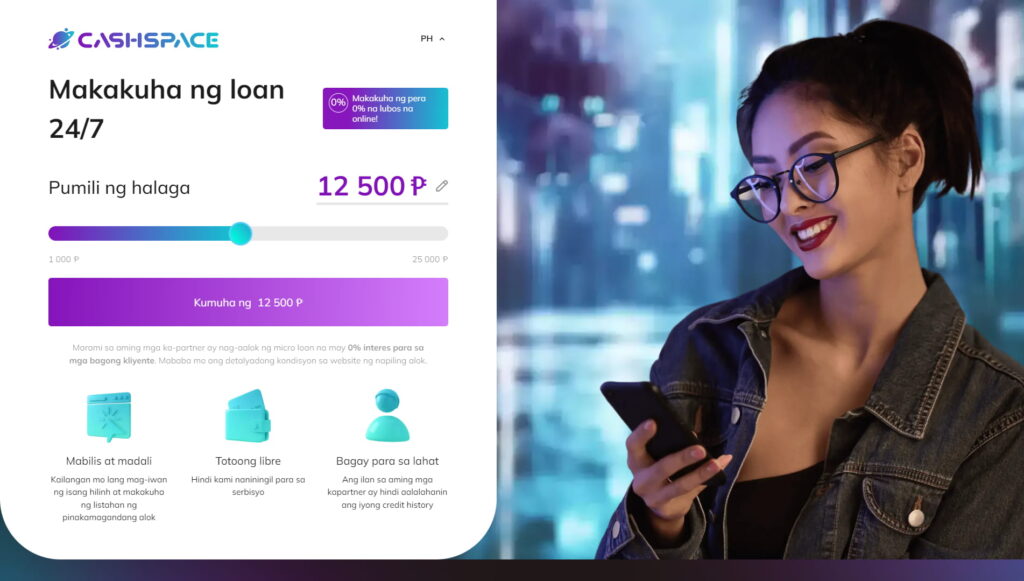

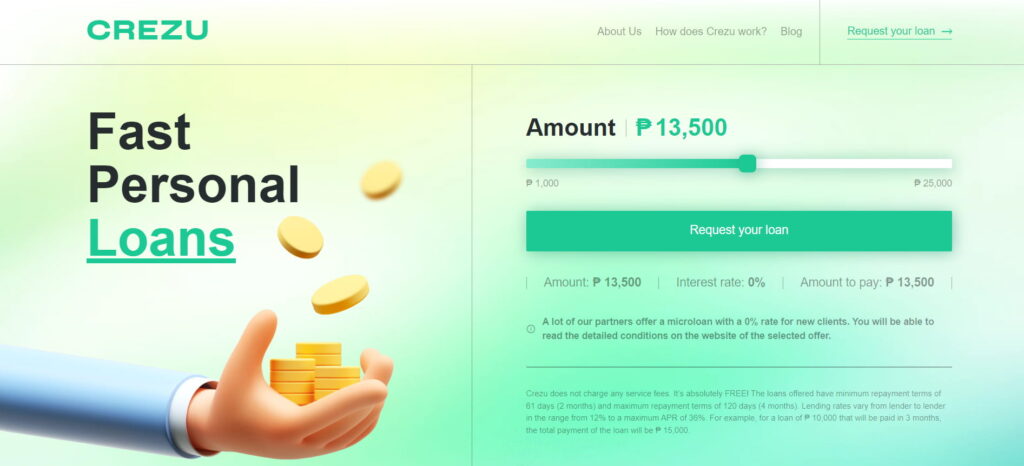

A loan calculator is like a helpful sidekick in finance ads. It lets users play around with the loan amount and duration using sliders or interactive elements. This way, users get a feel for the product right from the start and can see personalized loan offers instantly. It’s like trying on a financial product before committing, making it more engaging and user-friendly.

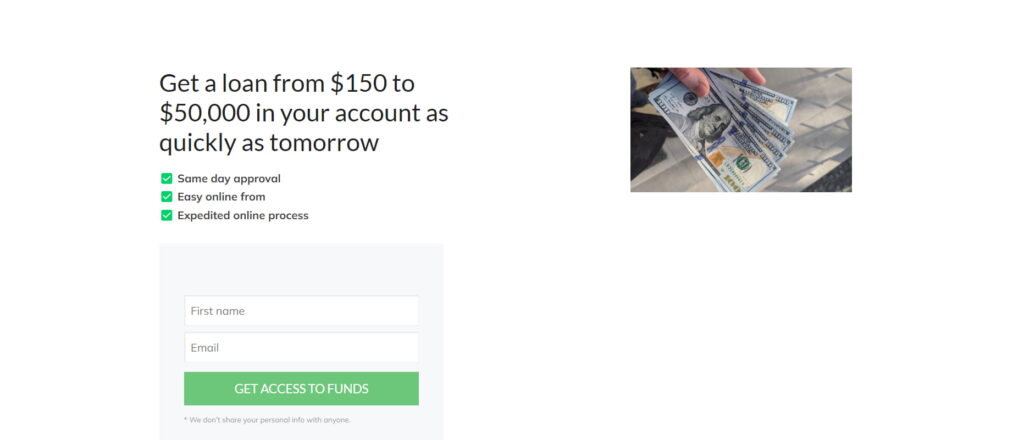

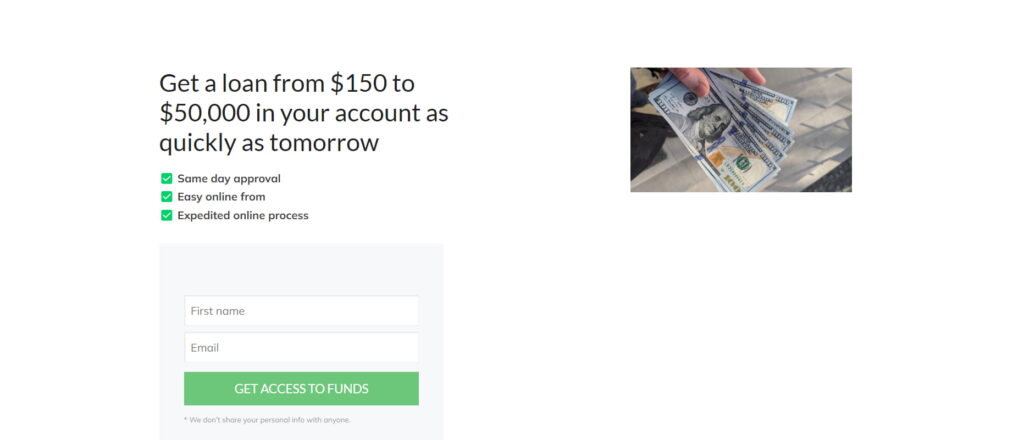

Examples of landing pages with loan calculator:

Affiliates can focus on the user-friendly interfaces, diverse investment options, and any unique features of the platform.

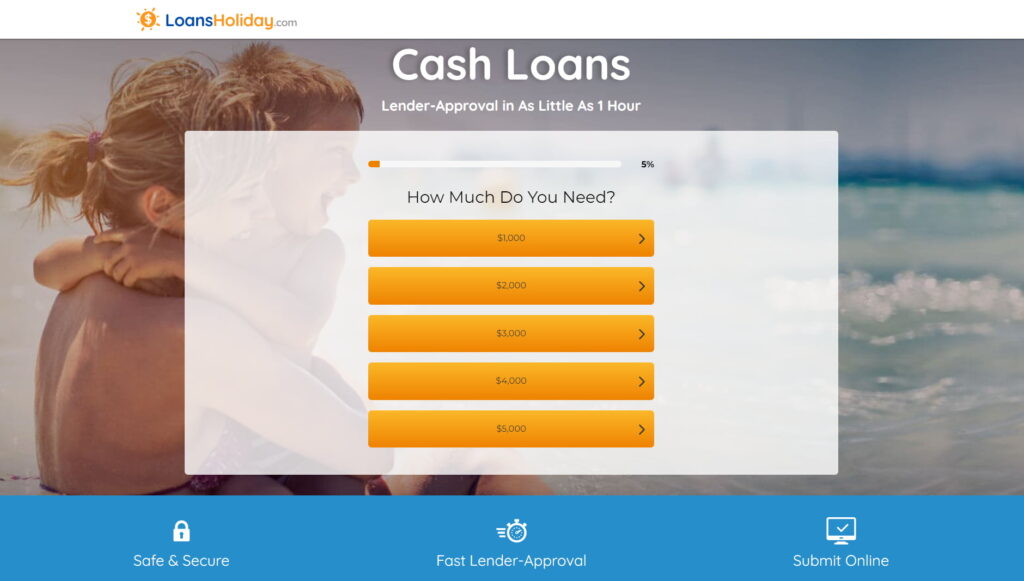

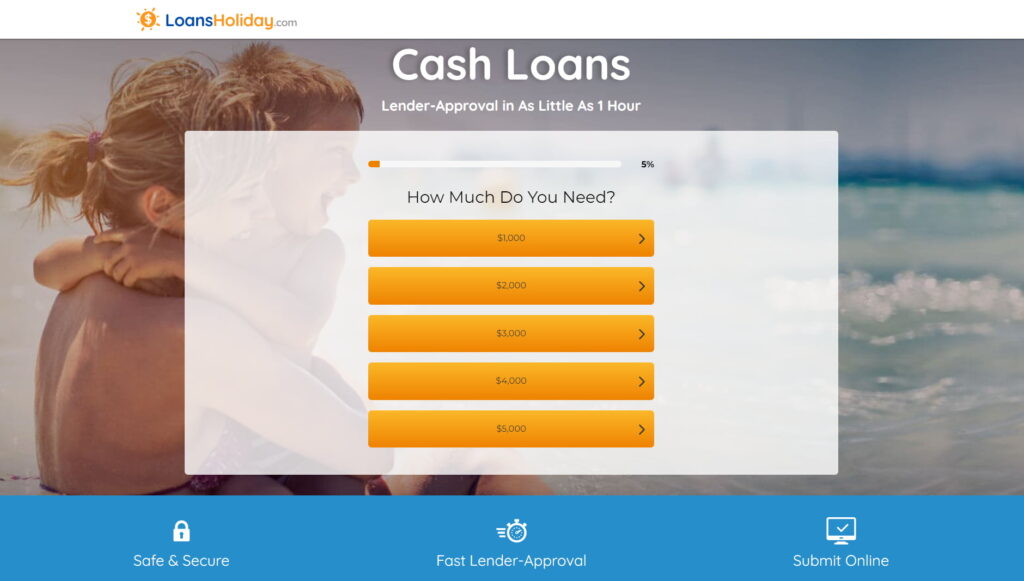

You may use quizzes and questionnaires to showcase an individual approach and build connections with your target audience.

An example of a finance questionnaire:

Be sure to highlight the competitive edge of your offer along with the questionnaire. As an example illustrates, the loan is approved in as little as 1 hour.

Demystify financial complexities by offering a clear yet comprehensive view of investment, trading platforms, and credit services. Through transparent terms, real-time market data, and numbers, empower users to navigate and capitalize on finance opportunities.

Share success stories or reviews and stay informative to position your platform as a trustworthy resource, affirming users’ autonomy in shaping their financial decisions.

If your offer packs solid benefits, it’s smart to lay all your cards on the table. Be upfront about the terms and include a lead form right away. Some users are straight shooters when it comes to finances — they prefer to cut to the chase without wading through lengthy explanations.

Introducing engaging pre-landing pages before the primary offer serves as a strategic approach.

Finance is a burgeoning vertical, matching the interests of both audiences: newbies and avid users of money services. It covers very diverse offers, so some deserve to be listed in a separate group, like Crypto or Forex. Just as offers, advertising approaches extremely vary depending on the offer characteristics. Given all the complexities dealing with the finance niche, the best recommendations are to absorb the successful practices from competitors and consider peculiarities of the certain traffic sources.

The niche where numbers dance, and fortunes are calculated in decimals is Finance. No matter how you slice it, everyone loves money, regardless of the season or economic climate. And this is the beauty of finance offers. Moreover, each can choose the offer according to their taste – there are plenty of options in the finance market: from bank cards to mortgages and insurance programs.

This affiliate marketing finance guide will unveil all aspects of the vertical. You’ll learn what finance offers are in the niche, how to work with them, and what pitfalls you may encounter.

Given the different ways people handle their money, the finance niche includes offers that vary in risk levels. Several of them are controversial, such as binary options or bail bonds, prohibited by Facebook, the strictest ad platform. Moving away from the extremes, we’ll describe common types of finance offers you may encounter most often.

Bank card offers encompass promotions encouraging individuals to apply for either debit or credit cards. Affiliates earn commissions when users successfully apply for a bank card through their referral links.

Debit cards, directly linked to users’ bank accounts, offer immediate access to funds and are ideal for everyday transactions. On the other hand, credit cards provide a pre-approved limit, enabling users to make purchases beyond their current financial means. These affiliate marketing financial services can help build credit history and often come with rewards programs, while debit cards promote budget-friendly spending.

How to navigate the niche:

The loan products category, covering personal loans, mortgage loans, and payday loans, presents diverse opportunities for affiliate marketing.

Affiliates can emphasize the convenience and quick approval processes of payday loans, appealing to users in urgent financial situations. However, the payday loan niche often faces regulatory challenges and scrutiny. Personal loans can be marketed based on flexibility and competitive interest rates. Affiliates focusing on the long-term investment aspect can benefit from mortgage loans. However, the mortgage market involves a lengthy and complex application process, making user acquisition more challenging for affiliates.

How to navigate the niche:

If quick validation and faster commissions are priorities, payday loans may be suitable. For affiliates seeking higher payouts and willing to invest time in user acquisition, personal loans and mortgages offer substantial earnings. Be mindful of compliance and regulatory considerations in the payday loan niche.

Affiliate marketing for investment and trading platforms involves promoting services enabling users to invest in stocks, cryptocurrencies, or financial instruments, such as Forex. Commissions are often tied to user registrations or deposits.

Cryptocurrencies deserve special attention as this niche involves a unique approach to making creatives and promotional strategies.

That’s why cryptocurrencies are often singled out as a separate vertical. We have a dedicated guide about Crypto.

Microfinance organizations (MFOs) are entities that offer financial services, such as small loans and financial products, to both individuals and businesses. These organizations play a crucial role for those who may not qualify for traditional bank loans. MFOs typically offer various types of loans with a focus on short-term financial needs. The key advantage lies in their ability to serve a diverse audience, offering quick approvals and flexibility in loan types to address specific financial circumstances.

Choose MFO offers when aiming for quick conversions, targeting a diverse audience underserved by traditional banks, and seeking flexibility in promotion strategies. MFOs are ideal for affiliates prioritizing short-term financial solutions, higher approval rates, and a varied portfolio to cater to different user needs.

Before diving headfirst into finance offers and their advantages, you should know about all possible roadblocks that can bother paving the way for entering the industry.

What difficulties advertisers may face when advertising finance offers:

All in all, dealing with finance affiliate marketing demands a meticulous and patient approach. Advertisers must delve into the intricacies of the target audience, navigate approval processes, and patiently invest time and resources. The rewards, however, are substantial, with diligent efforts resulting in a lucrative return on investment.

Views on why finance offers can be highly profitable for you.

Finance offers cater to a broad and diverse audience. From individuals seeking credit cards to those interested in investments, the potential consumer base is vast. This diversity allows advertisers to tailor campaigns to different segments, reaching a wide spectrum of potential customers.

Finance encompasses a plethora of products and services – credit cards, loans, investments, insurance, and more. Advertisers can capitalize on this variety to promote an array of offers. This not only widens the scope for audience engagement but also allows for strategic marketing based on the ever-evolving needs of consumers.

For those seeking handsome payouts, finance offers stand out with their high-earning potential. What makes it even more enticing is the prevalence of the revenue-sharing model in the finance industry. Unlike one-time payout structures, this approach ensures advertisers not only receive generous initial payments but also a continuous percentage from the lasting revenue generated by their referred clients.

When it comes to promoting finance offers, the choices seem endless. Let’s simplify it.

Here’s a rundown of user-friendly traffic sources and their key benefits for running finance ad campaigns:

Amidst these options, push notifications stand out for finance offers. Their immediacy and ability to capture attention make them ideal for financial promotions.

Push notification networks add an extra layer of efficiency, ensuring your finance messages reach the right audience swiftly. Consider this dynamic duo – push notifications and push networks – for a winning strategy in the finance advertising game. Embark on your finance campaign journey with the best push ad networks.

The target audience for finance offers is extremely diverse, as users can have completely different attitudes toward finances. While some are saving up and looking for profitable deposits to invest in, others waste money, resulting in the need for MFOs.

Additionally, there are various biases, such as the misconception that only the population of tier-3 countries is interested in loans, for example. To stay informed, we cross-referenced data with Google Trends statistics, identifying which traffic performs best across different GEOs.

Statistics show credit cards are viable for even such solvent countries as Canada, the US, the UK and Australia. South Korea rounds out this TOP-5.

Loan inquiries garner attention from audiences in Russia, Taiwan, Australia, the UK, and South Africa. Seek traffic sources that specialize in these GEOs to profit from loan advertising.

Those most interested in MFOs are located in South Africa, Kenya, Australia, the UK, and New Zealand.

Trading is predominantly a passion for the population from the UAE, Indonesia, Pakistan, Nigeria and India.

Make sure your target GEO compiles with the traffic source you choose for promoting your offer. Check out what countries are profitable in terms of Finance in the following ad networks: PropellerAds, Adsterra, Galaksion, Push.House, EZmob, AdCash and Kadam.

Advertisers have the creative freedom to incorporate diverse elements into their sales funnels. This could involve enticing lead magnets, such as exclusive financial guides or personalized budgeting tools, delivered directly to users’ inboxes.

Crypto adoption means fintech services start using digital currencies like Bitcoin. It’s simple and can make things like paying and getting paid quicker, safer, and cheaper because it doesn’t rely much on banks or government rules. It also gives everyone using these services more privacy. Plus, embracing crypto can be a big plus for an offer, making it stand out and more appealing to people looking for modern, secure financial solutions.

An example of in-page push creatives for the finance niche (crypto):

A loan calculator is like a helpful sidekick in finance ads. It lets users play around with the loan amount and duration using sliders or interactive elements. This way, users get a feel for the product right from the start and can see personalized loan offers instantly. It’s like trying on a financial product before committing, making it more engaging and user-friendly.

Examples of landing pages with loan calculator:

Affiliates can focus on the user-friendly interfaces, diverse investment options, and any unique features of the platform.

You may use quizzes and questionnaires to showcase an individual approach and build connections with your target audience.

An example of a finance questionnaire:

Be sure to highlight the competitive edge of your offer along with the questionnaire. As an example illustrates, the loan is approved in as little as 1 hour.

Demystify financial complexities by offering a clear yet comprehensive view of investment, trading platforms, and credit services. Through transparent terms, real-time market data, and numbers, empower users to navigate and capitalize on finance opportunities.

Share success stories or reviews and stay informative to position your platform as a trustworthy resource, affirming users’ autonomy in shaping their financial decisions.

If your offer packs solid benefits, it’s smart to lay all your cards on the table. Be upfront about the terms and include a lead form right away. Some users are straight shooters when it comes to finances — they prefer to cut to the chase without wading through lengthy explanations.

Introducing engaging pre-landing pages before the primary offer serves as a strategic approach.

Finance is a burgeoning vertical, matching the interests of both audiences: newbies and avid users of money services. It covers very diverse offers, so some deserve to be listed in a separate group, like Crypto or Forex. Just as offers, advertising approaches extremely vary depending on the offer characteristics. Given all the complexities dealing with the finance niche, the best recommendations are to absorb the successful practices from competitors and consider peculiarities of the certain traffic sources.

Blog

Blog